Analysts should be monitored on a trend line to gain a reasonable understanding of the ratio.

B. Overall Profitability

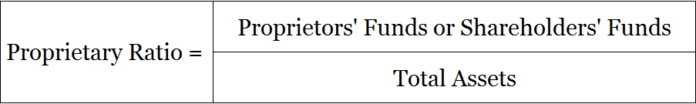

While a high proprietary ratio may be attractive for an early-stage startup, the company may have limited earning potential and require substantial investment to grow. Furthermore, the proprietary ratio indicates the amount that shareholders would receive in the event of company liquidation. It is usually expressed as a percentage and is calculated by dividing the shareholders’ equity by the total assets of the business. The proprietary ratio establishes the relationship between the funds provided by the “proprietors” and the company’s total assets.

Proprietary Ratio – Formula, Interpretation (Complete Guide)

The tax tips after january 1, 2021 is calculated by dividing proprietors’ funds by total assets. The proprietary ratio helps you measure how much the company’s stockholders are contributing to the total capital of the company. The proprietary ratio is a key solvency ratio used to assess a company’s financial stability by analyzing how much of its total assets are funded by shareholders’ equity. It provides insight into a company’s financial leverage and is critical for investors and creditors. In this blog, we’ll explore the meaning, formula, and significance of the proprietary ratio in detail.

- This could lead to creditors losing interest in providing finance to such a company, resulting in higher interest rates and a heightened risk of bankruptcy.

- Also, the machine required to make these bags is available at a purchase price of $5000.

- Proprietors’ funds include share capital, reserves and surpluses as per the balance sheet.

- Creditors and investors may view such a company as riskier, which could lead to higher borrowing costs or difficulty securing financing.

- This could raise concerns about the company’s ability to meet its long-term obligations, especially during economic downturns.

- The proprietary ratio and the debt-to-equity ratio are both crucial solvency ratios, but they measure different aspects of a company’s financial structure.

Get Funded Faster!

Additionally, the risk of insolvency or bankruptcy reduces considerably, which means the availability of loans at a lower interest rate. However, if the proprietary ratio is too high, the management cannot utilize the debt financing options wisely to generate profit. The solvency ratio is a critical financial measure that evaluates a company’s ability to meet its long-term debt obligations. It indicates the proportion of a company’s total assets financed by equity and debt, offering insight into the financial health and stability of a business. A higher solvency ratio suggests that the company is more capable of sustaining its debt load over time, while a lower ratio raises concerns about potential financial distress.

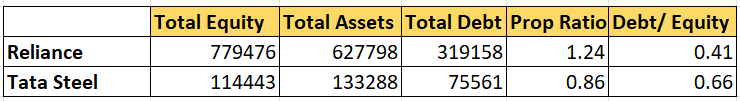

The proprietary ratio components are shareholders’ or proprietary funds and total assets, including goodwill, etc. The proprietary ratio is also known as the ‘equity ratio’ which indicates the portion of total assets being held by a company that is funded by the proprietors’ funds. The proprietary ratio and the debt-to-equity ratio are both crucial solvency ratios, but they measure different aspects of a company’s financial structure. While the proprietary ratio focuses on the proportion of a company’s assets financed by equity, the debt-to-equity ratio compares the total debt to shareholders’ equity. Proprietary ratio shows the proportion of total assets financed by proprietors’ funds.

How to Calculate the Proprietary Ratio

Proprietary ratio is a type of solvency ratio that is useful for determining the amount or contribution of shareholders or proprietors towards the total assets of the business. The proprietary ratio is calculated by dividing proprietors’ funds by total assets. Hence, the first method would increase our debt in the company and make us look risky. However, in the second method, the only thing visible in our financial statements would be the rent.

When a company’s proprietary ratio is high, it means that it has enough equity to be able to support its ongoing business operations. The proprietary ratio allows you to estimate the company’s capitalization used to fund the business. A higher Proprietary Ratio, close to 1 or 100%, is generally considered good as it signifies that a larger proportion of the company’s assets are backed by the shareholder’s equity. However, a suitable ratio can vary depending on the industry and individual company circumstances.

Therefore, the proprietary ratio is a significant measure in finance for decision making and future investment planning. It also shows a huge portion of debts in the total assets may minimize the creditor’s interest and increase the finance costs. Total assets include long-term assets & short-term assets include goodwill etc as per the balance sheet. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. Therefore, maintaining a balanced proprietary ratio is crucial for any business.