For example, raising prices increases contribution margin in the short term, but it could also lead to lower sales volume in the long run if buyers are unhappy about it. Before making any changes to your pricing or production processes, weigh the potential costs and benefits. Reduce variable costs by getting better deals on raw materials, packaging, and shipping, finding cheaper materials or alternatives, or reducing labor costs and time by improving efficiency. In the same example, CMR per unit is $100-$40/$100, which is equal to 0.60 or 60%. So, 60% of your revenue is available to cover your fixed costs and contribute to profit.

Contribution Margin: What Is It and How To Calculate It

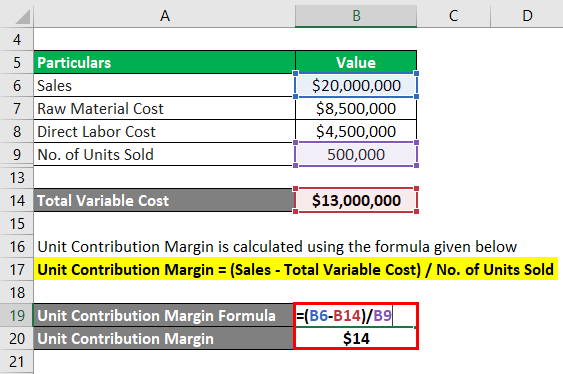

The contribution margin can be stated on a gross or per-unit basis. It represents the incremental money generated for each product/unit sold after deducting the variable portion of the firm’s costs. Investors often look at contribution margin as part of financial analysis to evaluate the company’s health and velocity.

Gross Profit Margin vs. Contribution Margin

Management uses this metric to understand what price they are able to charge for a product without losing money as production increases and scale continues. It also helps management understand which products and operations are profitable and which lines or departments need to be discontinued or closed. The contribution margin measures how efficiently a company can produce products and maintain low levels of variable costs. It is considered a managerial ratio because companies rarely report margins to the public.

What is the contribution margin ratio formula?

Potential investors can use contribution margin analysis to compare the offerings of acquisition targets as part of the due diligence process. Once you calculate your contribution margin, you can determine whether one product or another is ultimately better for your bottom line. Still, of course, this is just one of the critical financial metrics you need to master as a business owner. You can use contribution margin to help you make intelligent business decisions, especially concerning the kinds of products you make and how you price those products.

- My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers.

- This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

- Variable expenses can be compared year over year to establish a trend and show how profits are affected.

- In the Dobson Books Company example, the total variable costs of selling $200,000 worth of books were $80,000.

- Formerly a reporter, Soundarya now covers the evolving cybersecurity landscape, how it affects businesses and individuals, and how technology can help.

- As you can see, the contribution margin per-unit remains the same.

Contribution Margin Formula:

Therefore, the contribution margin reflects how much revenue exceeds the coinciding variable costs. In May, \(750\) of the Blue Jay models were sold as shown on the contribution margin income statement. When comparing the two statements, take note of what changed and what remained the same from April to May. For example, assume that the students are going to lease vans from their university’s motor pool to drive to their conference. A university van will hold eight passengers, at a cost of \(\$200\) per van.

Understanding the Basics

It means there’s more money for covering fixed costs and contributing to profit. The larger the contribution margin, the better, as it indicates more money to apply to fixed costs. What’s leftover after variable and fixed costs are covered is the profit. If the margin is negative, the company is losing money producing the product. To run a company successfully, you need to know everything about your business, including its financials.

The offers that appear on this site are from companies that compensate us. But this compensation does not influence the information we publish, or the reviews that you see on how to record a loan payment that includes interest and principal this site. We do not include the universe of companies or financial offers that may be available to you. We are an independent, advertising-supported comparison service.

Finance and accounting experts with real-world experience write our articles. Prior to publication, articles are checked thoroughly for quality and accuracy. Once upon a time, I was just like you – staring wide-eyed at financial documents, wondering why they couldn’t just be in plain English.